A Simple Math Lesson

The sub-prime lending crisis is another opportunity for us to test our math skills.

My children never seem to stop asking me the question: “When will I ever use math in real life?” Just the other day my daughter and her friend got into an argument as to which was more useful, statistics or calculus. I could resist the urge to say, “They are both important, we use calculus to calculate some very complicated statistics problems.” But, the truth is that the average American tries to avoid math at every opportunity.

The Christian Science Monitor used the ignorance of the American public to create a shocking graph and fear mongering story on the crisis. I don’t understand the reason for this obvious exaggeration of the lending crisis. Maybe its just to sell more papers. Maybe there is another reason. I honestly don’t know. But the graph and the story make it look like the world is crashing down all around us. The truth is bad enough for the people that this crisis effects. Why do we need to create panic among the rest of the people?

First of all lets look at the graph that the Christian Science Monitor published. It can be found here.

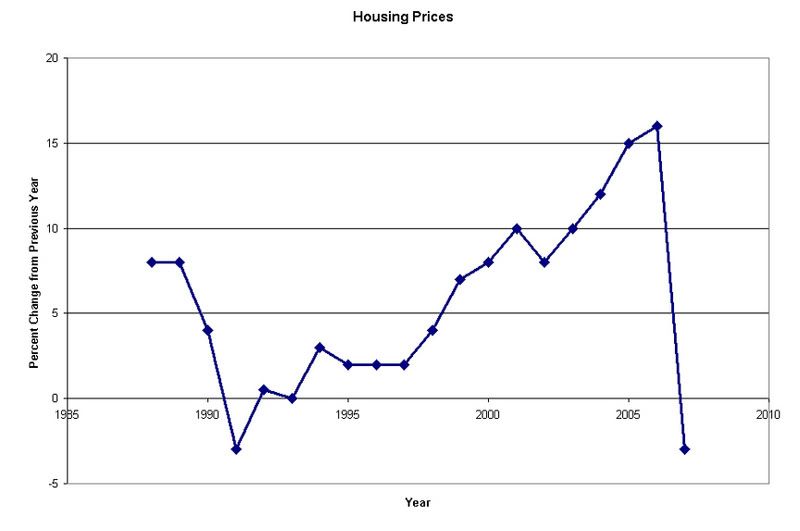

I reproduced the graph from the data presented. It looks like this:

This graph gives the impression that housing prices are going up, and then suddenly the bottom has dropped out this year. What the graph really shows is the housing bubble. If you read this graph more closely we see that the graph shows the percent increase from the year before. In a good economic situation we would like all objects to hold real value. We don’t like it when our car gets old and we need to buy a new one. The truth of the matter is that things age and fall apart. Similarly houses age and fall apart. But houses age slowly. Another reality is that inflation is real. In an ideal economic situation a house would be bought at a price, and at some time later it would be sold for the same price taking into account aging and inflation. And, a very low constant inflation rate would be the best situation.

When we move away from the ideal situation we suffer. This is because eventually the market catches up to the reality. This action in the housing market is known as bursting of the bubble. So, if we look at the reality of the situation the way that we all think about this we would come away with a calmer outlook on this crisis. I am not saying that there isn’t a crisis. Obviously people who bought houses last year are actually going to have loans for amounts that are greater than the current value of their home. Similarly many people were swindled into borrowing money that they could most likely never be able to pay back. But, the crisis isn’t as dire as the Christian Science Monitor suggests in this article.

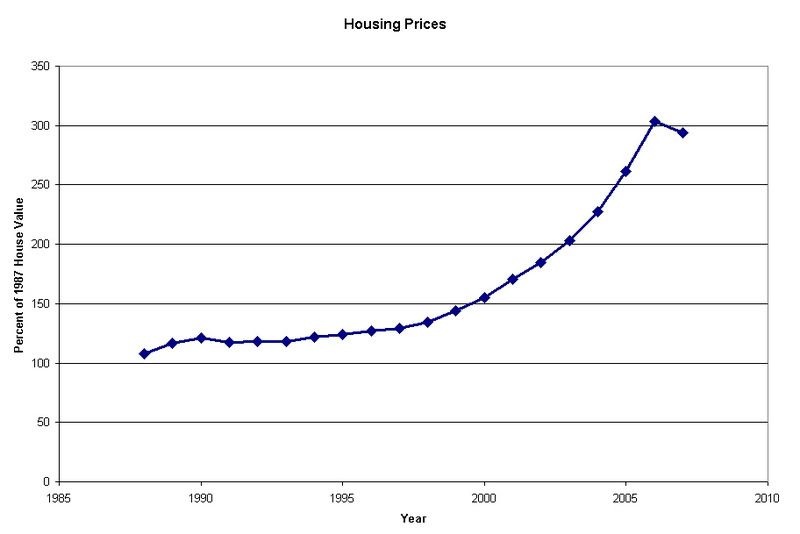

If we look at this same information in the way we normally would we see something much different. We see a house purchased in 1987 for 100% of its 1987 value. We can see the price of the house rise to over 300% of its 1987 value in 2006. Then in 2007 the price of the house falls to 294% of its 1987 value. These questions must be asked: “Is the person who’s house fell in value from 302% to 294% of its 1987 value really suffering very much? Have these people really lost anything that they deserved to have?”

The point here is that if you bought a house last year, and you want to sell it now you might have a problem. However, if you bought your house two years ago or more you have no problem even if you want to sell it today. Your house is worth less than what it was last year, but last year people were willing to pay more than its was actually worth. Most likely they are still willing to pay more than it is really worth, even though it is less than it was recently worth.

This sounds confusing, because people have a hard time realizing that 2007 dollars and 1987 dollars are not necessarily the same. People also don’t always understand percentages. And, in this case “percentage of change in price from the previous year” is not a clear concept. But, the real question is “Why would the Christian Science Monitor want to confuse the general public with this article?”

-----------------------------------------------------

Don't forget what Stephen Colbert said, "Reality has a well-known liberal bias."

Cross Posted @ Bring It On, tblog, Blogger and BlogSpirit

Reflection

My children never seem to stop asking me the question: “When will I ever use math in real life?” Just the other day my daughter and her friend got into an argument as to which was more useful, statistics or calculus. I could resist the urge to say, “They are both important, we use calculus to calculate some very complicated statistics problems.” But, the truth is that the average American tries to avoid math at every opportunity.

The Christian Science Monitor used the ignorance of the American public to create a shocking graph and fear mongering story on the crisis. I don’t understand the reason for this obvious exaggeration of the lending crisis. Maybe its just to sell more papers. Maybe there is another reason. I honestly don’t know. But the graph and the story make it look like the world is crashing down all around us. The truth is bad enough for the people that this crisis effects. Why do we need to create panic among the rest of the people?

First of all lets look at the graph that the Christian Science Monitor published. It can be found here.

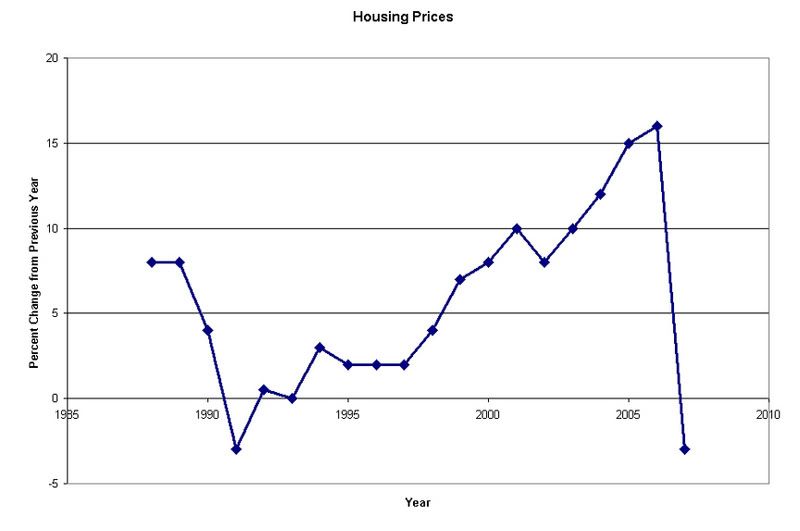

I reproduced the graph from the data presented. It looks like this:

This graph gives the impression that housing prices are going up, and then suddenly the bottom has dropped out this year. What the graph really shows is the housing bubble. If you read this graph more closely we see that the graph shows the percent increase from the year before. In a good economic situation we would like all objects to hold real value. We don’t like it when our car gets old and we need to buy a new one. The truth of the matter is that things age and fall apart. Similarly houses age and fall apart. But houses age slowly. Another reality is that inflation is real. In an ideal economic situation a house would be bought at a price, and at some time later it would be sold for the same price taking into account aging and inflation. And, a very low constant inflation rate would be the best situation.

When we move away from the ideal situation we suffer. This is because eventually the market catches up to the reality. This action in the housing market is known as bursting of the bubble. So, if we look at the reality of the situation the way that we all think about this we would come away with a calmer outlook on this crisis. I am not saying that there isn’t a crisis. Obviously people who bought houses last year are actually going to have loans for amounts that are greater than the current value of their home. Similarly many people were swindled into borrowing money that they could most likely never be able to pay back. But, the crisis isn’t as dire as the Christian Science Monitor suggests in this article.

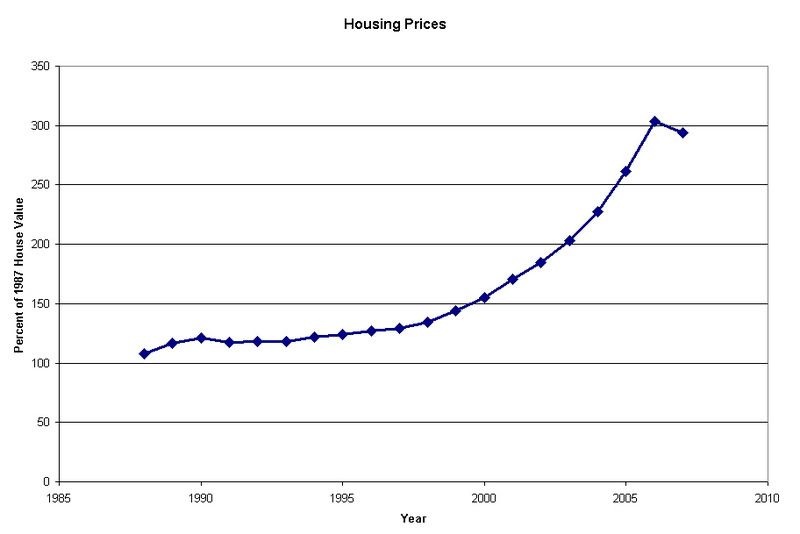

If we look at this same information in the way we normally would we see something much different. We see a house purchased in 1987 for 100% of its 1987 value. We can see the price of the house rise to over 300% of its 1987 value in 2006. Then in 2007 the price of the house falls to 294% of its 1987 value. These questions must be asked: “Is the person who’s house fell in value from 302% to 294% of its 1987 value really suffering very much? Have these people really lost anything that they deserved to have?”

The point here is that if you bought a house last year, and you want to sell it now you might have a problem. However, if you bought your house two years ago or more you have no problem even if you want to sell it today. Your house is worth less than what it was last year, but last year people were willing to pay more than its was actually worth. Most likely they are still willing to pay more than it is really worth, even though it is less than it was recently worth.

This sounds confusing, because people have a hard time realizing that 2007 dollars and 1987 dollars are not necessarily the same. People also don’t always understand percentages. And, in this case “percentage of change in price from the previous year” is not a clear concept. But, the real question is “Why would the Christian Science Monitor want to confuse the general public with this article?”

-----------------------------------------------------

Don't forget what Stephen Colbert said, "Reality has a well-known liberal bias."

Cross Posted @ Bring It On, tblog, Blogger and BlogSpirit

Reflection